The BMA recognises the growing importance of innovation in the insurance and wider financial services industry, and the critical role that innovation plays in promoting efficiency and enhancing competitiveness in the market. Therefore, the Authority launched two parallel innovation tracks: an Insurance Regulatory Sandbox (Sandbox) and an Innovation Hub, both initially targeted at Insurance Technology (InsurTech) companies.

Insurance Regulatory Sandbox

The Sandbox is an innovation track for companies looking to test new technologies or business models on a limited number of clients in a controlled environment and for a limited period of time. The Sandbox is reserved for companies that will be undertaking licensable activities as defined under the Insurance Act 1978.

Participating Companies:

| Company Name | Sandbox Licence | Project Overview | Sandbox Licence Expiry | Sandbox Status |

| Nimble Insurance Ltd. | Innovative Insurer - Class IGB |

Nimble aims to establish a decentralized insurance marketplace on blockchain technology, utilizing artificial intelligence and machine learning software to enable members to purchase insurance coverage. | 12 September 2025 | Active |

| Bo Wang Re (Bermuda) Ltd. | Innovative Insurers - IGB | Bo Wang Re utilises artificial intelligence and machine learning to offer Battery Extended Warranty insurance products for electric vehicles. The Company's initial target market is China's electric vehicle industry and its export market. | 30 May 2026 | Active |

| CatX Limited | Innovative Intermediary - IMP | CatX is an innovative marketplace for insurance risk, connecting brokers and (re)insurers with capital market institutions to efficiently model, price and secure (re)insurance and retro protection. | 15 December 2025 | Active |

| Blackbird ILS Marketplace Ltd. | Innovative Intermediary - IMP | A closed-end liquid market for structured, syndicated and modelled cyber exposure and other specialty risk as fixed-income products. The market facilitates the trading of insurance-linked security bonds between insurers, reinsurers and sophisticated investors. | 8 September 2025 | Active |

| Meanwhile Insurance Bitcoin (Bermuda) Limited | Innovative Insurers - ILT | Offers bitcoin-denominated long term insurance products. The project’s initial target clientele are high-net-worth individuals/sophisticated investors as defined under the Investment Funds Act 2006. | 29 December 2024 |

Graduated Post-sandbox licence: Class IILT effective 25 July 2024 |

| Chainproof Digital Asset Insurance Ltd | Innovative Insurers - IGB | Offers smart contract insurance against loss or theft of digital assets. The project’s initial target clientele are institutional asset managers for vetted decentralised finance (DeFi) systems. | 6 May 2024 |

Graduated Post-sandbox licence: Class IIGB effective 6 May 2024 |

| Ensuro Re Limited | Innovative Insurers - IGB | Ensuro utilises smart contracts to pool capital in the form of stablecoins from "Liquidity Providers" and provide underwriting capacity for Insurtech companies operating in the parametric insurance space. During the sandbox period the company is restricted to institutional “Liquidity Providers” only. Please note this company is also licensed under the Digital Asset Business Act 2018. | 1 January 2025 |

Graduated Post-sandbox licence: Class IIGB effective 30 April 2024 |

| Breach Insurance, Ltd. | Innovative Insurers - IGB | Offers fiat-denominated and crypto-denominated insurance solutions for cyber theft exposures on select cryptocurrency exchange platforms. | 6 October 2023 |

Graduated Post-sandbox licence: Class IIGB effective 3 February 2023 |

| Kettle Limited | Innovative Intermediary - IA | An insurance agent underwriting catastrophe coverage on behalf of target capacity providers using proprietary machine learning algorithms technology to create optimal portfolios of risk. The project's initial focus is on California wildfire exposures. | 12 March 2023 |

Graduated Post-sandbox licence: Insurance Agent effective 19 August 2022 |

| Nayms SAC Ltd. (formerly Nayms Ecosystems Limited) | Innovative Insurers - IGB | A smart contract powered platform that allows insurance entities to create fully-collateralised, fully digital, transparent, trustless and tradable reinsurance contracts. Please note this company is also licensed under the Digital Asset Business Act 2018. | 1 May 2022 |

Graduated Post-sandbox licence: Class IIGB effective 1 May 2022 |

| AkinovA (Bermuda) Ltd | Innovative Intermediary - IMP | An electronic marketplace to transfer and trade insurance risks, enabling cedants and intermediaries acting on their behalf to transfer insurance risk to investors | 26 December 2020 |

Graduated Post-sandbox licence: Insurance Marketplace Provider effective 1 January 2021 |

| DNX Intermediaries (Bermuda) Limited | Innovative Intermediary - IB | DNX Intermediaries is creating an ecosystem known as the DeNexus Cyber Risk Management Trusted Ecosystem (DeNexus Trusted Ecosystem) which creates and prices “fit for purpose” cyber risk transfer products for both risk owners and assumers. | 23 June 2024 | Exited the sandbox |

Innovation Hub

Participating Companies:

| Project Name | Project Overview | Company |

| ArCoin | Arca Insurance Company Limited (Arca) and the Bermuda Monetary Authority (BMA) will collaborate to conduct a series of structured tests of ArCoin, a digital asset security token representing shares in the Arca U.S. Treasury Fund. These tests will assess the operational efficacy, compliance adherence and practical utility of ArCoin within the regulated BMA Innovation Hub environment. | Arca Insurance Company |

Past Innovation Hub Participants:

| Project Name | Project Overview | Company |

| Aanika Insurance Agent | Aanika is seeking to develop insurance products, namely product liability, crop insurance and food/product recall, which incorporate their proprietary microbial tagging technology in their supply chain. | Aanika Biosciences, Inc. |

| Avert | Leveraging block-chain technology to build an automated insurance platform for captive insurance management to serve the digitally-native and blockchain-native business community. | Mothership Holdings, LLC |

| BioTag-backed Contamination and Recall and General Liability Insurance | Index is developing an insurance product that responds to high-risk food recalls which incorporates their proprietary proof of ownership technology. | Index Biosystems Inc. |

| Digital Tax Stamp Insurance | MAP Insurance is aiming to develop a proof-of-concept that would facilitate smart contracts for Digital Tax Stamps in trade credit insurance. | MAP Insurance Ltd. |

| Explainable AI | Legal-Pythia aims to use the Innovation Hub to evaluate how the company’s Explainable AI and greenwashing detection solutions function in a regulatory setting. | Legal-Pythia |

| Fixed Risk Contract | Development of a regulated, non-negotiated capital markets product that mitigates the risk of property damage caused by natural disaster, by paying out upon recognition of a set of clearly defined circumstances. | Telluriq Investment Company Limited |

| Longitude Exchange | Longitude Exchange is seeking to be a marketplace for hedging, investing in, and trading mortality and longevity risk leveraging quantitative insight, finance and data analytics. | Longitude Solutions LLC, Adjacent and VB Risk Advisory B.V. |

| Remitrix Edge and Remitrix Horizon | Modules which use Machine Learning to improve the prediction and automation of the actuarial parameter modelling process required for capital modelling by insurers and reinsurers. Initial focus is on EU Solvency II and IFRS17 capital modelling. | Remitrix Ltd. |

| RiCap BERMUDA | A blockchain-driven electronic platform allowing brokers, insurance companies and reinsurers to do business in a single platform to improve business efficiency and cut frictional cost (phase 1), as well as build a private business network to access third party capital (phase 2 and 3). | ChainThat Limited |

| Sura Risks and Trends | Suramericana S.A. aims to reduce the protection gap of insurance portfolios that respond to emerging and/or not considered risks in the market, with a focus on low-carbon economy insurance opportunities and strategic risks. | Suramericana S.A. |

IMPORTANT LINKS:

- Guidance Note: Insurance Regulatory Sandbox and Innovation Hub

- Schedule a call with our Insurance Innovation team

- Insurance-Regulatory-Sandbox-Application-Form-Checklist

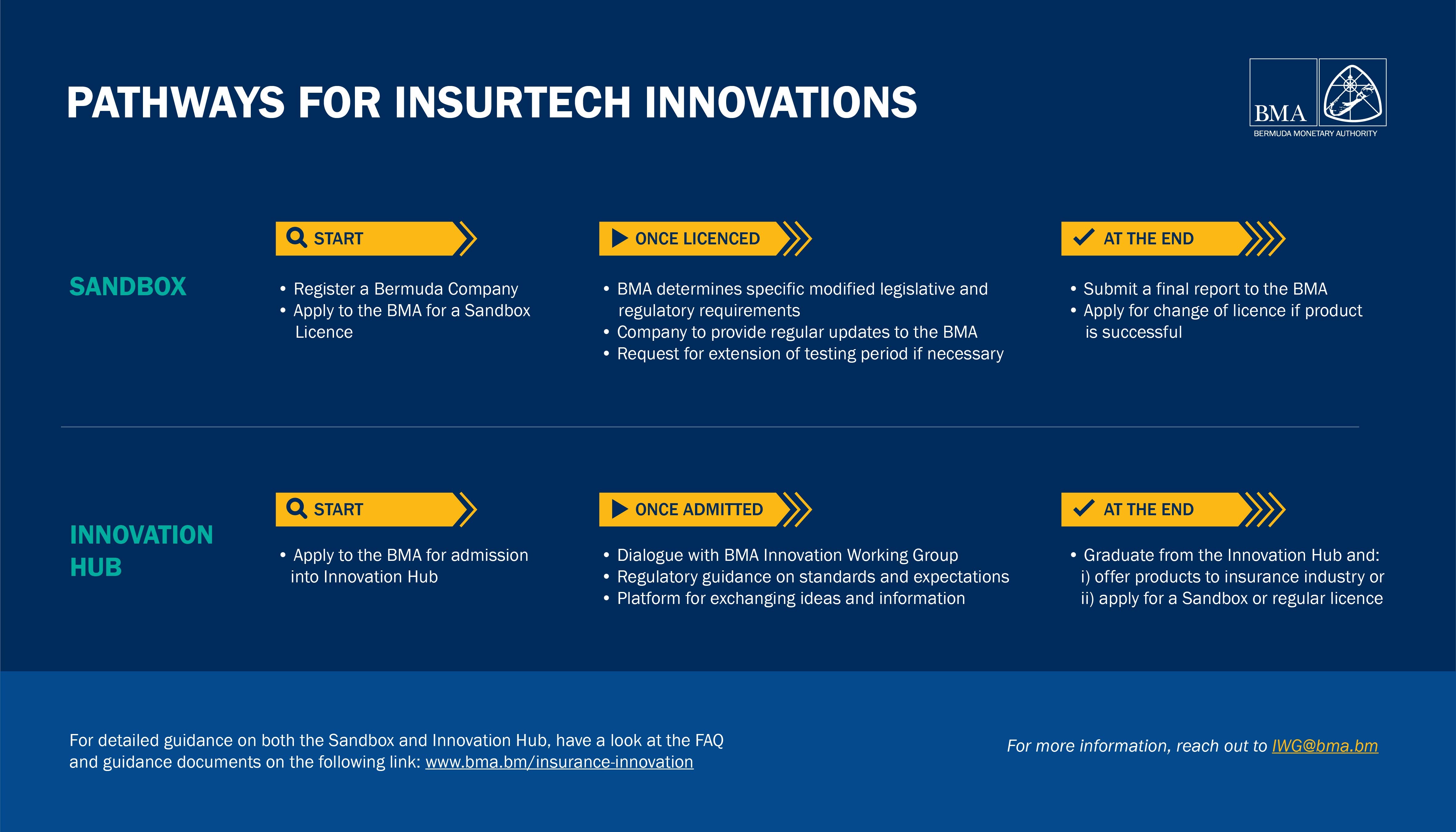

- Sandbox and Innovation Hub Infographic: